Free Downloads

This downloadable content is Excel spreadsheet based or PDF based.

These free templates are for your own use (personal or internal business use). You may not resell them, share it publicly, upload it to other websites, or include them in any paid product or service.

Last updated: Jan 31, 2026

A simple income and expense tracker for business owners

A simple income and expense tracker for farmers.

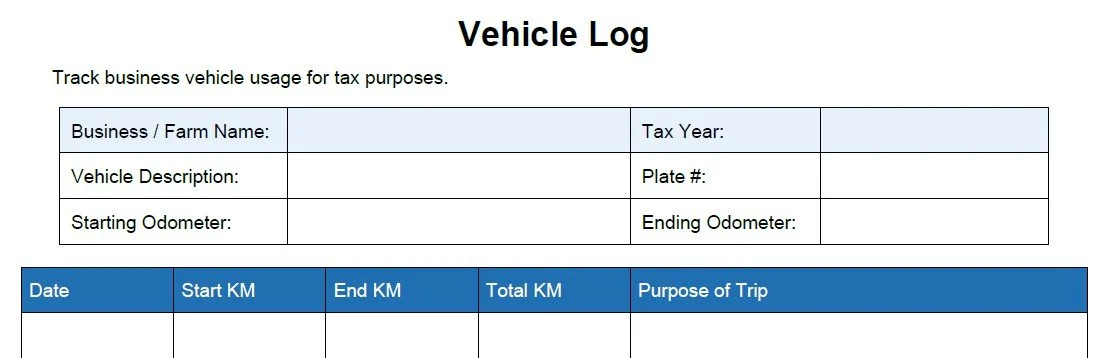

A simple PDF based vehicle logbook. Can be printed.

-

Get ready to file https://www.canada.ca/en/services/taxes/income-tax/personal-income-tax/get-ready-taxes.html

Sign in to your CRA account (My Account) https://www.canada.ca/en/revenue-agency/services/e-services/cra-login-services.html

Register for a CRA account https://www.canada.ca/en/revenue-agency/services/e-services/cra-login-services/register-cra-sign-in-services.html

TFSA contribution room (how to calculate/check) https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/tax-free-savings-account/contributing/calculate-room.html

All deductions, credits & expenses (searchable list) | https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/deductions-credits-expenses.html

-

Guide T4002 – Self-employed business & professional income | https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/t4002.html

Report business income and expenses (hub) https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/sole-proprietorships-partnerships/report-business-income-expenses.html

Business expenses (overview) | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/sole-proprietorships-partnerships/business-expenses.html

Business-use-of-home expenses (workspace in home) | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/sole-proprietorships-partnerships/report-business-income-expenses/completing-form-t2125/business-use-home-expenses.html

Sole proprietorship (CRA overview) | https://www.canada.ca/en/revenue-agency/services/tax/businesses/small-businesses-self-employed-income/setting-your-business/sole-proprietorship.html

When to register for and start charging GST/HST | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/when-register-charge.html

Register for a GST/HST account | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/gst-hst-account/register-account.html

-

GST/HST for businesses (main hub) | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses.html

When to register and start charging GST/HST | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/when-register-charge.html

Register for a GST/HST account | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/gst-hst-account/register-account.html

Register voluntarily (small suppliers) | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/account-register-voluntarily.html

Reporting requirements and deadlines | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/file-gst-hst-return/reporting-requirements-deadlines.html

Remit (pay) the GST/HST you collected | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/remit-pay-gst-hst-collected.html

General Information for GST/HST Registrants (RC4022) | https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/rc4022/general-information-gst-hst-registrants.html

-

Corporation income tax return (T2) – main hub | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/corporations/corporation-income-tax-return.html

T2 Corporation Income Tax Return (form) | https://www.canada.ca/en/revenue-agency/services/forms-publications/forms/t2.html

T4012 – T2 Corporation Income Tax Guide (2024) | https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/t4012.html

Completing your corporation income tax (T2) return | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/corporations/corporation-income-tax-return/completing-your-corporation-income-tax-t2-return.html

Corporation Internet Filing (file your T2 online) | https://www.canada.ca/en/revenue-agency/services/e-services/digital-services-businesses/corporation-internet-filing.html

About Corporation Internet Filing (web access code / EFILE details) | https://www.canada.ca/en/revenue-agency/services/e-services/digital-services-businesses/corporation-internet-filing/about-corporation-internet-filing-service.html

Where to send your corporation income tax (T2) return | https://www.canada.ca/en/revenue-agency/corporate/contact-information/where-send-your-corporation-income-tax-t2-return.html

After you file your corporation income tax return | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/corporations/after-you-file-your-corporation-income-tax-return.html

Requesting a reassessment of your T2 return | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/corporations/after-you-file-your-corporation-income-tax-return/reassessments-adjustments-your-t2-return/requesting-a-reassessment-your-t2-return.html

-

Personal tax due dates & payment dates (Individuals) | https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/important-dates-individuals.html

Get ready to file (includes the earliest online filing date) | https://www.canada.ca/en/services/taxes/income-tax/personal-income-tax/get-ready-taxes.html

RRSP / FHSA / HBP / LLP important dates (RRSP deadline page) | https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/rrsps-related-plans/important-dates-rrsp-rrif-rdsp.html

Income tax instalment due dates (Individuals) | https://www.canada.ca/en/revenue-agency/services/payments/payments-cra/individual-payments/income-tax-instalments/due-dates.html

GST/HST reporting requirements & deadlines | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/file-gst-hst-return/reporting-requirements-deadlines.html

Payroll remittance due dates (source deductions) | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/remitting-source-deductions/how-when-remit-due-dates.html

Employers’ Guide T4001 (remitter schedules + due dates) | https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/t4001/employers-guide-payroll-deductions-remittances.html

Corporation T2 filing deadline (6 months after year-end) | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/corporations/corporation-income-tax-return/when-file-your-corporation-income-tax-return.html

Corporate balance-due day (2 or 3 months after year-end, depending) | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/corporations/corporation-payments/paying-your-balance-corporation-tax/balance-day.html

Prescribed interest rates (quarterly) | https://www.canada.ca/en/revenue-agency/services/tax/prescribed-interest-rates.html

Current quarter interest rates details | https://www.canada.ca/en/revenue-agency/services/tax/prescribed-interest-rates/2026-q1.html

Tax rates & income brackets (current + previous years) | https://www.canada.ca/en/revenue-agency/services/tax/individuals/frequently-asked-questions-individuals/canadian-income-tax-rates-individuals-current-previous-years.html

CPP contribution rates & maximums (CRA payroll) | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/payroll-deductions-contributions/canada-pension-plan-cpp/cpp-contribution-rates-maximums-exemptions.html

EI premium rates & maximums (CRA payroll) | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/payroll-deductions-contributions/employment-insurance-ei/ei-premium-rates-maximums.html

-

Payroll (Employers) – main hub | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll.html

Get a payroll program account (RP) | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/open-manage-payroll-program-account.html

Business number (BN) and program accounts – register | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/business-registration/business-number-program-account/how-register.html

Payroll deductions online calculator (PDOC) | https://www.canada.ca/en/revenue-agency/services/e-services/digital-services-businesses/payroll-deductions-online-calculator.html

CPP contributions (employer/employee) | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/cpp.html

EI premiums (employer/employee) | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/ei.html

How and when to remit (payroll deductions) | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/remitting-source-deductions.html

Remittance due dates | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/remitting-source-deductions/due-dates.html

Make a payment to the CRA (business) | https://www.canada.ca/en/revenue-agency/services/payments/payments-cra/business-payments/make-payment.html

T4 slips and T4 Summary (information return) | https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/rc4120.html

File T4 slips online (Web Forms) | https://www.canada.ca/en/revenue-agency/services/e-services/digital-services-businesses/internet-file-transfer.html

T4 slip (form) | https://www.canada.ca/en/revenue-agency/services/forms-publications/forms/t4.html

T4 Summary (form) | https://www.canada.ca/en/revenue-agency/services/forms-publications/forms/t4summary.html

Records you need to keep (payroll records) | https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/keeping-records.html

About My Business Account (view balances, remittances, mail) | https://www.canada.ca/en/revenue-agency/services/e-services/digital-services-businesses/business-account/about-business-account.html